Total Addressable Market (TAM)

The total potential revenue opportunity for a product or service in a given market.

Also called: Total Addressable Market, TAM, Addressable Market, Total Market, Market Opportunity, Total Available Market, Total Market Size, and Total Market Demand

See also: Product/Market Fit

Relevant metrics: Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), Conversion Rate, Retention Rate, and Average Revenue Per User (ARPU)

How to calculate Total Addressable Market (TAM):

TAM = Number of Potential Customers x Average Revenue per User (ARPU)

What is the Total Addressable Market (TAM)?

Total Addressable Market (TAM), also known as total available market, represents the overall revenue opportunity available for a product or service if it achieved 100% market share. This metric is crucial for businesses as it helps determine the potential scale and impact of a new product or business line, guiding investment and strategic decisions.

Total Addressable Market (TAM) is the total potential revenue opportunity for a product or service in a given market. It is expected by multiplying the total number of potential customers in a market by the average revenue per customer. TAM is used to measure the potential size of a market and is a key factor in determining the potential success of a product or service.

TAM is vital for both startups and established businesses. It allows companies to prioritize specific products, customer segments, and business opportunities by understanding the required resources and potential revenue. This metric helps in evaluating the viability of business opportunities, estimating market size, overall investment needed, competitive landscape, unique differentiators, and expected growth rates.

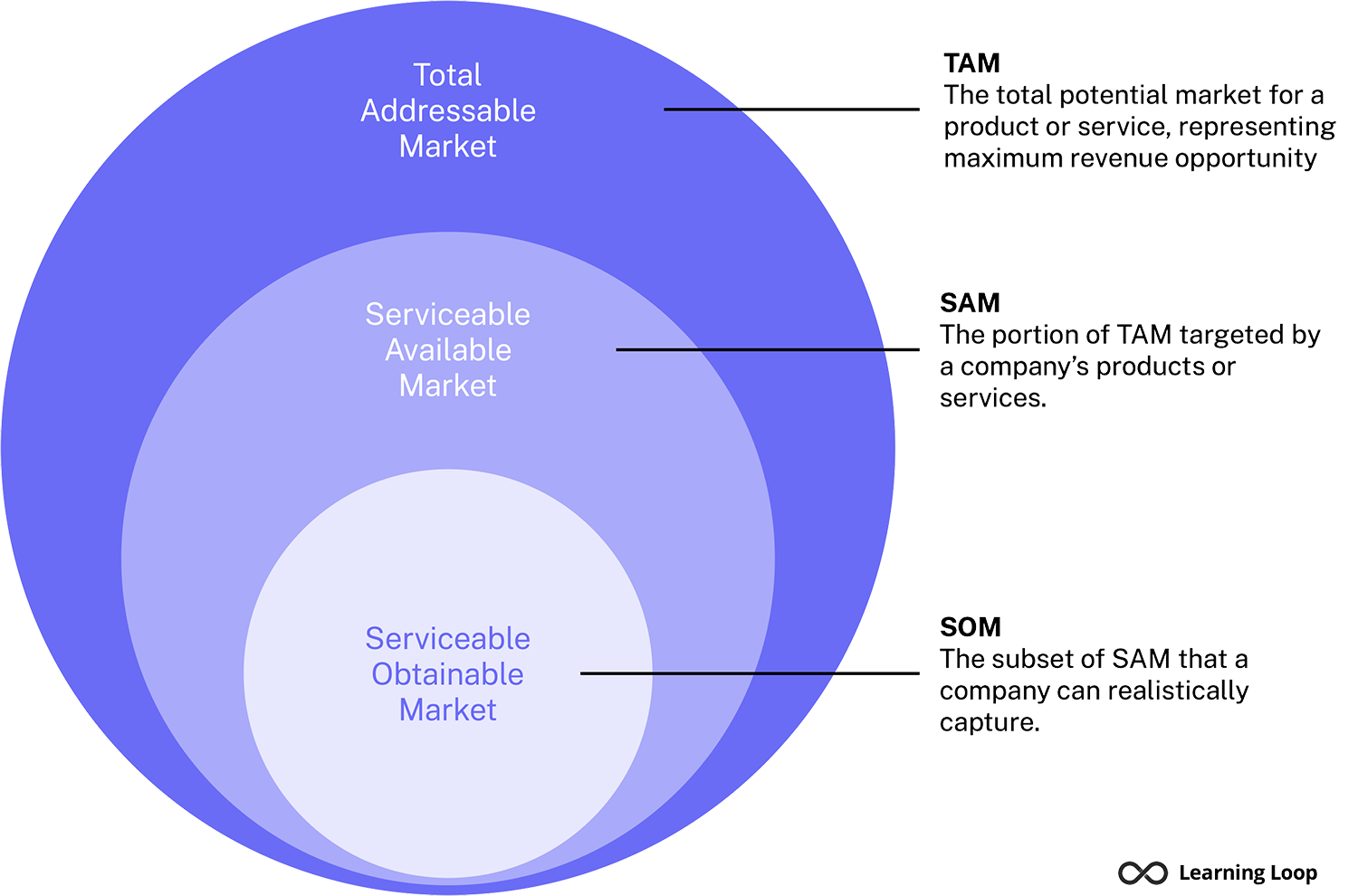

TAM, SAM, and SOM

Total Addressable Market (TAM), also known as total available market, represents the overall revenue opportunity available for a product or service if it achieved 100% market share.

It is worth to notice that there is a significant difference beteween the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

- Total Addressable Market (TAM). TAM represents the total potential market for a product or service, reflecting the maximum revenue opportunity if the product achieved 100% market share. It provides a high-level view of the market’s overall potential size and is useful for understanding the broader opportunity landscape. TAM helps businesses understand the full scope of the market opportunity, guiding long-term strategic planning.

- Serviceable Available Market (SAM). SAM is the portion of the TAM that a company’s products or services can serve. It narrows down the TAM by considering factors such as geographical limitations, market segments, and product-specific constraints. SAM is a more focused subset of TAM, highlighting the target market that is realistically accessible by the company. SAM focuses efforts on the most relevant and accessible market segments, ensuring efficient use of resources.

- Serviceable Obtainable Market (SOM). SOM is the subset of SAM that a company can realistically capture, considering its current capabilities, resources, and competitive positioning. It represents the achievable market share within the SAM and is crucial for setting realistic sales and marketing targets. SOM sets realistic goals and expectations, grounding business plans in achievable targets.

Where did Total Addressable Market (TAM) come from?

The concept of Total Addressable Market (TAM) originated from the fields of business strategy and market analysis, where understanding the potential market size and revenue opportunities is crucial for decision-making. The precise origin of TAM as a formal concept is not tied to a single individual or moment in history. Instead, it evolved over time as businesses and market analysts sought systematic ways to evaluate the potential of new products, services, and market opportunities.

The use of TAM became more prominent with the rise of modern marketing and strategic planning in the mid-20th century. As companies began to expand their operations and explore new markets, there was a growing need to quantify the potential size and profitability of these markets. This led to the development of various market analysis tools and frameworks, including TAM.

How to calculate TAM

There are three primary methods for calculating TAM:

Top-Down approach

The top-down approach starts with a broad population of a known size and narrows down to a specific market segment using industry research and reports. For example, if a technology startup offers accounting software targeting small businesses, it might use industry data showing the total number of businesses and then narrow this number down based on specific criteria relevant to their target market.

Example: If there are 1 billion businesses worldwide and 30% lack premium accounting software, the potential market is 300 million businesses. Further refining this based on relevant criteria (e.g., 10% are potential customers) leads to a TAM estimation.

Bottom-Up approach

The bottom-up approach relies on primary market research and existing data about current pricing and product usage. This method is often more accurate as it is based on data from the company’s own research or surveys.

Example: A startup with an accounting app priced at $100 per year might estimate the number of potential customers through direct surveys and existing user data to calculate TAM.

Value Theory

The value theory approach estimates TAM based on the value provided to customers and how much of that value can be captured through pricing. This method is useful for new products or when cross-selling to existing customers.

Example: Uber might use this approach by estimating the value users derive from its service compared to alternatives and determining how much users are willing to pay.

What is an example of a Total Addressable Market (TAM)?

Example of a Total Addressable Market (TAM)

To illustrate the concept of Total Addressable Market (TAM), consider a hypothetical scenario involving a new fitness app targeting the global market. Here’s how the TAM could be calculated:

Step 1: Define the Target Market

The company identifies its target market as individuals who are interested in fitness and own a smartphone. For this example, let’s assume the following data:

- Global population: 7.8 billion

- Percentage of smartphone users: 45%

- Percentage of smartphone users interested in fitness: 25%

Step 2: Calculate the Number of Potential Customers

Using the data above, the potential number of customers can be estimated:

- Total smartphone users: 7.8 billion * 45% = 3.51 billion

- Smartphone users interested in fitness: 3.51 billion * 25% = 877.5 million

Step 3: Determine the Average Revenue Per User (ARPU)

The company decides to offer a subscription model for the fitness app, priced at $10 per month. The annual revenue per user would be:

- ARPU: $10 * 12 months = $120 per year

Step 4: Calculate the TAM

Finally, the Total Addressable Market (TAM) can be calculated by multiplying the number of potential customers by the ARPU:

- TAM: 877.5 million users * $120 per year = $105.3 billion

In this example, the TAM for the new fitness app is $105.3 billion. This represents the maximum revenue opportunity if the app were to capture 100% of the target market of fitness-interested smartphone users globally. This calculation helps the company understand the potential scale of the opportunity and make informed decisions about investment and strategy.

What is a good size TAM?

What is a Good Size for TAM?

Determining a “good” size for Total Addressable Market (TAM) depends on several factors, including the type of business, the industry, the competitive landscape, and the company’s goals and resources. Here are some considerations for assessing whether a TAM size is favorable:

Factors influencing a good TAM size:

- Industry Standards.

- Different industries have varying benchmarks for what constitutes a good TAM. For example, in the tech industry, a TAM of several billion dollars might be expected due to the global nature of technology products and services. In contrast, niche markets might have smaller TAMs but can still be highly profitable.

- Startup vs. Established Company.

- For startups, a larger TAM can be attractive as it suggests significant growth potential and the possibility to capture a substantial market share. For established companies, the focus might be on capturing specific segments of a large TAM or expanding into adjacent markets.

- Investment and Funding.

- Investors typically prefer markets with a larger TAM because it indicates more significant potential for return on investment (ROI). A larger TAM can justify higher levels of funding and investment in product development and marketing.

- Market Penetration Potential.

- A good TAM size should also consider the realistic potential for market penetration. Even if the TAM is large, factors such as competition, customer acquisition costs, and regulatory hurdles can impact the achievable market share.

- Revenue Goals.

- The TAM should align with the company’s revenue goals. A business aiming for rapid growth will need a larger TAM to support its ambitious targets, while a company focused on steady, sustainable growth might be satisfied with a smaller TAM that offers high profitability.

Evaluating TAM sizes for your business

Understand the competitive landscape, customer needs, and market trends. A larger TAM might be attractive, but the ease of market entry and potential profitability are equally important.

Ensure the TAM aligns with your business model and growth strategy. Consider whether your company can realistically capture a meaningful share of the market given your resources and capabilities.

For startups seeking investment, ensure the TAM is large enough to meet investor expectations for growth and ROI. A compelling TAM can make your business more attractive to venture capitalists and other investors.

A good size for TAM is context-dependent and varies based on industry standards, company goals, and market dynamics. Generally, larger TAMs are attractive for their growth potential, but the ability to capture and serve the market effectively is crucial. Assessing TAM should be part of a broader strategic evaluation that includes competitive analysis, market penetration potential, and alignment with business objectives.

Why is TAM an important metric?

TAM helps companies understand the total market potential and guides strategic decisions about product development, market entry, and resource allocation. By calculating TAM, businesses can determine whether an opportunity is worth pursuing and allocate resources accordingly. TAM is also crucial for investor communications, providing a sense of the market opportunity and potential return on investment.

When considering new products, market segments, or features, TAM helps predict potential revenue and growth, ensuring informed decision-making. Additionally, TAM calculations are vital for assessing the impact of new market entrants or pricing changes, enabling businesses to anticipate changes in market share and revenue.

Frequently Asked Questions about TAM

What is the differences between TAM, SAM, and SOM?

- TAM (Total Addressable Market). The total potential market for a product or service, representing maximum revenue opportunity.

- SAM (Serviceable Available Market). The portion of TAM targeted by a company’s products or services.

- SOM (Serviceable Obtainable Market). The subset of SAM that a company can realistically capture.

For example, in the UK food market valued at 200 billion euros (TAM), the alcoholic drinks market might be 49 billion euros (SAM). A specific manufacturer’s share within this market would be the SOM.

Is TAM the same as market size?

No, TAM (Total Addressable Market) is not the same as market size. TAM represents the maximum revenue opportunity if a product or service achieved 100% market share in a given market. In contrast, market size typically refers to the current or projected revenue from existing players and products within that market. TAM is a broader concept used to understand the full potential of a market, while market size often reflects more immediate, realistic market conditions.

Is TAM always global?

No, TAM (Total Addressable Market) is not always global. TAM can be calculated for different geographic scopes, such as global, regional, or local markets, depending on the business’s target market and strategic goals. Companies may focus on a specific geographic area based on their capabilities, market conditions, and growth strategies. Therefore, TAM can be adjusted to reflect the potential market within the chosen scope.

How do I increase TAM?

Increasing your Total Addressable Market (TAM) involves expanding the potential market for your product or service. Here are several strategies to achieve this:

- Expand Geographically. Entering new geographic markets can significantly increase your TAM. This could mean launching your product in new regions, countries, or even continents. Consider localizing your product to meet the specific needs and preferences of these new markets.

- Diversify Product Offerings. Develop new products or services that appeal to different customer segments. By diversifying your portfolio, you can attract new customers who were not previously served by your existing offerings.

- Address New Customer Segments. Identify and target additional customer segments within your existing market. This might involve adapting your marketing strategies to appeal to different demographics, industries, or use cases.

- Enhance Product Features. Adding new features or functionalities to your product can attract a broader audience. This could involve integrating with other popular services, adding new capabilities that meet more diverse needs, or improving usability and accessibility.

- Adjust Pricing Models. Offering different pricing tiers or subscription models can make your product accessible to a wider range of customers. Introducing lower-cost options or premium tiers can attract customers with different budget levels.

- Enter Adjacent Markets. Identify markets related to your current one where your product could provide value. For example, a company specializing in accounting software for small businesses might expand into payroll or human resources management software.

- Innovate with New Technologies. Adopting or developing new technologies can create entirely new market opportunities. Innovation can differentiate your product and attract customers who are looking for cutting-edge solutions.

- Increase Marketing and Sales Efforts. Boosting your marketing and sales efforts can help you reach a larger audience. Invest in marketing campaigns, expand your sales team, and use data-driven strategies to identify and target potential customers more effectively.

- Form Strategic Partnerships. Collaborating with other companies can help you tap into their customer base. Strategic partnerships, joint ventures, and alliances can open up new distribution channels and market opportunities.

- Improve Customer Retention. While not directly increasing TAM, improving customer retention can lead to increased word-of-mouth referrals and brand loyalty, indirectly expanding your market reach. Happy customers are more likely to recommend your product to others, effectively increasing your potential market.

Consider a company that produces fitness tracking devices. To increase its TAM, the company could:

- Expand its product line to include devices for specific sports (e.g., swimming, cycling).

- Enter new geographic markets, such as Asia or South America.

- Develop a premium service that offers personalized coaching based on fitness data.

- Partner with popular fitness apps to integrate their services.

Increasing TAM involves a combination of strategies focused on expanding geographic reach, diversifying product offerings, targeting new customer segments, enhancing product features, and forming strategic partnerships. By continuously exploring new opportunities and adapting to market demands, businesses can effectively increase their TAM and drive growth.

Examples

Airbnb

Airbnb used TAM to estimate the potential market for short-term rentals worldwide. By analyzing the total number of travelers and the demand for alternative accommodations to traditional hotels, Airbnb could determine the market size. This information was crucial for attracting investors and guiding their expansion strategy. They looked at factors like the number of international tourists, average spending on accommodations, and the growing trend of seeking unique travel experiences.

Source: Airbnb's S-1 filing for its IPO

Salesforce

Salesforce, a leading customer relationship management (CRM) platform, utilizes TAM to identify the potential revenue from businesses that could benefit from their software. By calculating TAM, Salesforce can focus on industries and sectors with the highest potential for growth. This helps them tailor their marketing efforts, sales strategies, and product development to meet the needs of large and underserved markets. Salesforce considers factors such as the number of businesses in different industries, the adoption rate of CRM solutions, and the average expenditure on CRM software.

Netflix

Netflix uses TAM to estimate the potential market for its streaming services. By understanding the number of households with internet access and the willingness of these households to pay for streaming content, Netflix can estimate its potential revenue. This helps Netflix decide which regions to enter next and how to price their services. Netflix looks at factors like internet penetration rates, competition from other streaming services, and content consumption habits.

Netflix

Netflix uses TAM to estimate the potential market for its streaming services. By understanding the number of households with internet access and the willingness of these households to pay for streaming content, Netflix can estimate its potential revenue. This helps Netflix decide which regions to enter next and how to price their services. Netflix looks at factors like internet penetration rates, competition from other streaming services, and content consumption habits.

Apple

Apple frequently uses TAM to guide the development and marketing of its products. For instance, before launching the Apple Watch, Apple analyzed the total potential market for wearable devices, including fitness trackers and smartwatches. By understanding the size of this market, Apple could make informed decisions about product features, pricing, and marketing strategies. Apple considered factors such as the growth rate of the wearable technology market, consumer interest in health and fitness tracking, and the integration potential with other Apple devices.

Uber

Uber, the ride-sharing giant, uses TAM to evaluate its market opportunities globally. When Uber was expanding its services, it needed to understand the potential market size in each new city or country. By calculating TAM, Uber could assess the potential number of users and revenue from each market. This helped them prioritize expansion efforts and allocate resources effectively. They considered factors like the number of potential riders, average fare prices, and the frequency of rides to estimate the overall revenue opportunity.

Source: Uber's Path of Destruction

- What is the size of the market I am targeting?

- What is the potential for growth in this market?

- What is the competitive landscape like in this market?

- What are the key drivers of demand in this market?

- What are the key trends in this market?

- What are the key customer segments in this market?

- What are the key customer needs in this market?

- What are the key barriers to entry in this market?

- What are the key opportunities in this market?

- What are the key risks in this market?

You might also be interested in reading up on:

- The New Rules of Sales and Service: How to Use Agile Selling, RealTime Customer Engagement, Big Data, Content, and Storytelling to Grow Your Business by David Meerman Scott (2017)

- The Sales Acceleration Formula: Using Data, Technology, and Inbound Selling to Go from $0 to $100 Million by Mark Roberge (2015)

- From Impossible to Inevitable: How HyperGrowth Companies Create Predictable Revenue by David Skok (2016)

- The Predictable Revenue Guide: Double Your Sales With Lead Generation You Can Scale by Mark Roberge (2018)

- Predictable Revenue: Turn Your Business Into a Sales Machine with the $100 Million Best Practices of Salesforce.com by Aaron Ross and Marylou Tyler (2011)