Business Model Generation: Revenue streams

Crowdfunding

Finance product development through a crowd of investors

How: Fund a product, project or entire startup through donations, offering rewards for money, lending or equity. When a critical mass of funding is achieved, the idea will be realized and investors receive their benefits, if any.

Why: Mitigate product development risk by putting your concept to the test of the crowd while possibly gaining working capital and great publicity at the same time.

Crowdfunding is a method of seeking financial support for a project from a large number of people, typically via the internet. This approach is designed to dilute the influence of professional investors and give the general public an opportunity to invest in and shape the development of a project. To gain backers, projects will typically launch awareness-raising campaigns that outline the details of the project and the rewards that backers can expect to receive in return for their support. These rewards may include the finished product itself or additional bonuses such as exclusive content.

Funding through crowdfunding is often an all-or-nothing proposition, meaning that a project will only be fully funded if it reaches its minimum funding goal. This structure helps to reduce the risk of abandoned projects, as creators will only proceed if they are confident that they will receive sufficient support.

Private individuals and collectives are often the primary backers of crowdfunding projects. They may be motivated by a desire to see a particular project come to fruition, rather than simply seeking a financial return. To encourage this type of altruistic investing, some crowdfunding platforms may impose limits on the amount that an individual can invest in a given project. In some cases, these limits are now legally mandated as part of financial regulations put in place in the wake of the global financial crisis.

For project creators, crowdfunding represents an opportunity to secure advantageous financing terms and to expand their pool of investors. It can also serve as a form of free advertising, potentially boosting the success of a product or project once it is completed.

Where did the Crowdfunding business model pattern originate from?

The concept of crowdfunding can be traced back to ancient times, when members of the public would contribute funds towards the construction of temples and other communal projects. In recent years, the proliferation of the internet and the emergence of dedicated crowdfunding platforms have made this financing model increasingly attractive for businesses and individuals.

One of the earliest examples of crowdfunding in a modern context occurred in 1997, when British rock band Marillion sought funding from their fans to support a tour of the United States. The band, which was signed to a small record label, was unable to cover the costs of the tour on their own. However, through a crowdfunding campaign launched online, they were able to secure the necessary funds from their dedicated fan base. Since this initial foray into crowdfunding, Marillion has continued to make use of this financing model for various projects.

Applying the Crowdfunding business model

There are several reasons why crowdfunding is an appealing option for businesses and individuals.

First and foremost, it provides access to crucial financial resources without the need to pay interest on loans. This can be particularly beneficial for those who may not have the necessary collateral or credit history to secure traditional forms of financing.

In addition to providing financial support, crowdfunding also allows project creators to gauge the potential success of their ideas early on and receive valuable feedback from interested members of the public. This can help them to refine their plans and avoid the cost of building prototypes or conducting costly pilot tests.

Overall, crowdfunding is a good option for those who have an appealing idea and believe that they can secure the support of a large number of backers. It offers a way to validate and bring new concepts to fruition with the help of the crowd.

Real life Crowdfunding examples

Pebble Time

Raising over $20 million for product development in 2015, it was the most funded project in Kickstarter history at the time.

Roofstock One

Taking care of all operating responsibilities, Roofstock One lets customers buy small shares of individual rental homes.

Trigger Questions

- Could the backers of our campaign potentially become customers or devoted supporters of our product?

- Can your idea be exciting enough to raise sufficient interest and reach to be fully funded?

- What kinds of rewards will you offer funders?

- How can we safeguard our intellectual property rights?

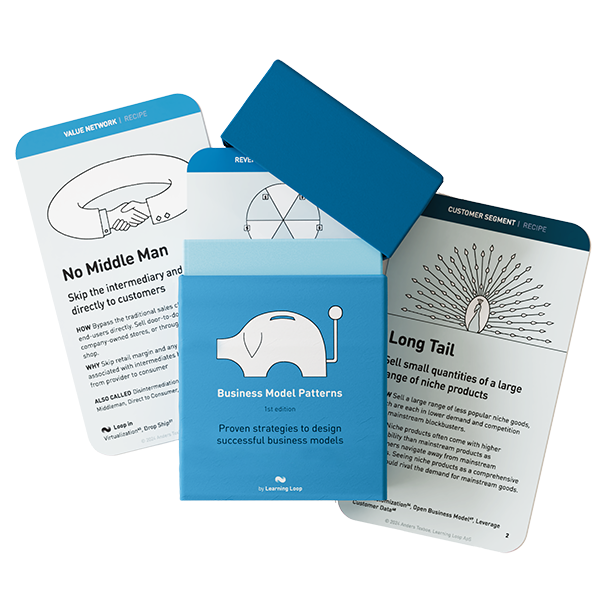

Proven business models that have driven success for global leaders across industries. Rethink how your business can create, deliver, and capture value.

Get your deck!Related plays

- Business Model Navigator by Karolin Frankenberger and Oliver Gassmann

- The Different Business Models of Crowdfunding by Lisa Walls-Hester

- Crowdfunding Validation Patternn by Anders Toxboe