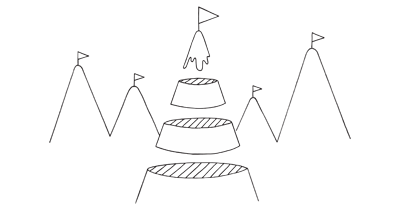

Idea Validation: Problem, Market demand

Discovery Survey

Gather user insights and needs through targeted surveys

How: Create and distribute surveys focused on understanding user needs, preferences, and pain points. Analyze responses for trends and insights to inform product development.

Why: Discovery surveys reach a wide audience quickly, providing valuable data on user needs and market trends. They are especially useful for complementing qualitative methods such as interviews and observations by validating and enriching the qualitative findings.

Discovery Surveys are a fast, cost-effective way to gather early insights from a broad audience. Used during the initial stages of product development, they help product teams validate assumptions, map user behaviors, and understand needs at scale. While surveys are sometimes criticized for producing shallow data, when designed and deployed correctly, they serve as a powerful complement to qualitative research methods like interviews and field studies.

This method is not about confirming feature ideas or testing UI preferences. It’s about uncovering patterns and preferences that inform where to dig deeper. As a discovery tool, the quality of a survey’s insights depends entirely on the intent, design, and interpretation of its results.

Why use a Discovery Survey?

Discovery Surveys are particularly useful when teams want to cast a wide net. They allow you to:

- Collect input from many users quickly

- Validate or challenge assumptions quantitatively

- Segment responses to understand different personas

- Identify themes to explore in future interviews

Unlike usability testing or in-depth interviews, surveys can reach hundreds or thousands of participants with minimal cost and effort. This makes them ideal for identifying broad trends or prioritizing what to explore next in the discovery process.

When to use Discovery Surveys?

Discovery Surveys are most effective at key moments:

- Early discovery: To understand user needs, frustrations, and context of use

- Before prioritization: To assess how widespread a problem or need really is

- Post-launch retrospectives: To capture changes in perception or satisfaction over time

- Complement to qualitative work: To validate or extend interview findings with larger samples

Surveys should not be used to replace deeper methods like interviews or direct observation, but to guide and support them. As noted by Nielsen Norman Group, they are best suited for answering the “what” and “how many,” but not the “why.”

Crafting an effective Discovery Survey

Creating a discovery survey is less about compiling a list of clever questions and more about constructing a thoughtful experience that invites useful, honest responses. It begins with a clear understanding of your research goals. Before writing any questions, clarify what you want to learn. Are you exploring unmet needs? Gauging pain point frequency? Segmenting different types of users? The clearer your intent, the more focused your survey will be.

With your goals in mind, the next step is to write questions that align with them. This may sound obvious, but many surveys become muddled with off-topic questions that feel like filler or an internal wishlist. Each question should earn its place. It should be specific, relevant, and necessary to support your discovery objectives.

Clarity in wording is critical. Avoid jargon and complex phrasing that could confuse respondents. Keep the language natural and neutral. Leading questions—those that subtly suggest a preferred answer—are especially dangerous in surveys because they quietly bias the results at scale. Likewise, avoid double-barreled questions that ask two things at once, as they force users to guess how to respond.

Another core principle of good survey design is to focus on past behavior rather than hypothetical intent. People are generally poor predictors of their future actions. Instead of asking “Would you use a feature like X?”, ask about what they’ve done in similar situations or what tools they currently use. Past behavior is almost always a better predictor of future behavior than self-reported intention.

It’s also important to consider question format. Closed-ended questions provide structure and facilitate analysis, but they can be limiting. A well-placed open-ended question allows respondents to elaborate, reveal surprises, or highlight edge cases. The key is to use open questions sparingly and purposefully—when you genuinely need qualitative input to enrich quantitative trends.

Survey fatigue is real. If your survey is longer than 5–10 minutes, you risk drop-off or disengagement. Respect the time and effort of your respondents. A tight, well-edited survey not only increases completion rates but also signals that you value their input.

Before sending out the final version, always pilot your survey with a small internal or external group. Ask them to note any confusing language, unclear answer choices, or logic issues. These small pre-launch checks often catch the problems that could undermine your entire effort.

As a final checklist before launch:

- Are the survey goals clearly defined?

- Does each question directly support those goals?

- Is the language simple, neutral, and clear?

- Are hypothetical or leading questions avoided?

- Is there a balance between open and closed question types?

- Is the total length respectful of the respondent’s time?

- Has the survey been tested by a small sample?

A well-crafted discovery survey is not a standalone solution—but it is an invaluable tool for broad listening. When designed with care and intent, it provides the kind of structured insight that helps teams prioritize their next steps with confidence.

Getting it right

A common trap is treating surveys as passive data collection tools rather than research instruments. This leads to bloated, aimless surveys that frustrate users and produce noisy data. Another pitfall is interpreting results at face value without triangulating them with behavioral data or qualitative context.

Discovery Surveys should rarely be used as your first step in product discovery. If you don’t yet understand the user’s world, a survey is likely to mislead more than clarify. Always pair surveys with interviews, usability testing, or ethnographic methods when possible.

Another risk is building surveys that act more like feature wish lists or marketing check-ins, rather than true research instruments. Maze and other tools stress the importance of separating exploratory surveys from evaluative ones—each requires different framing and intent.

Interpreting data from Discovery Surveys

The best use of survey data in discovery is directional. Use it to:

- Identify unexpected patterns across user groups

- Prioritize which problems or use cases to investigate next

- Segment your audience based on needs, attitudes, or behaviors

- Create hypotheses to validate through interviews or prototypes

Don’t treat survey percentages as final answers. Use them as fuel for curiosity. And avoid overconfidence—survey data should guide your next questions, not dictate your roadmap.

Related methods

Complementary and Follow-Up Methods

To maximize learning and ensure you’re gathering insight from multiple angles, Discovery Surveys should be integrated into a broader research process. A Discovery Survey rarely lives in isolation. It works best when paired with other research methods that provide additional context or enable deeper exploration. One natural precursor is the customer interview, which allows researchers to understand the language, problems, and motivations that should inform survey design. Interviews often help uncover the right questions to ask at scale.

After a survey, methods like follow-up interviews or usability testing can be used to explore the “why” behind certain patterns or outliers in the data. For example, if many respondents report frustration with a task, interviews can help explore those frustrations in depth, while usability tests can reveal how they unfold in real interaction.

Another useful complement is diary studies, especially when survey data points to behaviors that occur over time. Diary studies can help capture longitudinal patterns that surveys can’t access.

For teams using structured discovery tools, consider mapping survey findings into an Opportunity Solution Tree to clarify which themes represent the biggest opportunities. Or use a Data Sheet or Concept Card as a follow-up to present early solutions to the most pressing problems identified through your survey.

Complementary approaches also include Competitive Analysis, which helps benchmark user expectations and identify market gaps that survey results might hint at. Similarly, Micro Surveys—short, in-context questions triggered within a product experience—can build on broader Discovery Survey findings by targeting specific moments of user behavior.

In short, a Discovery Survey should be embedded in a larger learning cycle. Each insight it surfaces should either confirm existing knowledge or open a door to further investigation.

A useful method - if used right

Surveys are often dismissed because they’re so easy to misuse. But when built thoughtfully, they are one of the few scalable tools we have to learn from large groups of users. A Discovery Survey is not about collecting vanity metrics or forcing users into feature checklists—it’s about listening with breadth, at the right time.

Think of your survey as a conversation starter, not a decision-maker. The best teams use it to spark the next question, not to claim the final answer. And remember: surveys are not shortcuts to insight—they are just one part of a rigorous discovery practice.

Popular tools

The tools below will help you with the Discovery Survey play.

-

Maze

Maze allows teams to quickly deploy user-friendly surveys and tests with integrated analytics. Ideal for discovery research at scale, it supports branching logic, panel targeting, and pairing surveys with usability studies.

-

Typeform

A popular survey tool known for its conversational and accessible interface. Typeform is suitable for building engaging discovery surveys that keep participants involved and deliver high completion rates.

-

Google Forms

Free and simple to use, Google Forms provides a fast way to run basic discovery surveys. While lightweight, it's great for early-stage idea validation or internal testing.

-

SurveyMonkey

A long-established platform offering robust survey logic, distribution, and analysis tools. Useful for teams conducting larger-scale discovery surveys with statistical rigor.

-

Sprig

Sprig specializes in in-product micro surveys, allowing teams to capture user insights in real time during actual product usage. Ideal for pairing with Discovery Surveys to collect feedback at key touchpoints.

-

Great Question

A continuous research platform that includes survey tools, panel management, and follow-up interview scheduling. Supports seamless integration between survey insights and customer conversations.

-

Hubble

Built for product teams, Hubble allows for survey creation, experiment tracking, and integration with roadmaps. Designed to fit into agile product development and discovery workflows.

-

Qualtrics

An enterprise-grade survey platform with advanced analytics and segmentation capabilities. Suitable for discovery surveys where statistical precision and stakeholder reporting are essential.

Real life Discovery Survey examples

Airbnb

Airbnb utilized discovery surveys to understand market trends and user preferences, significantly impacting their service offerings and market positioning.

Spotify

Spotify uses discovery surveys to gauge user music preferences, creating better personalized playlists and improving user engagement with their music streaming service.

A collection of clever product discovery methods that help you get to the bottom of customer needs and coining the right problem before building solutions. They are regularly used by product builders at companies like Google, Facebook, Dropbox, and Amazon.

Get your deck!Related plays

- Survey Best Practices by Nielsen Norman Group at Nielsen Norman Group

- Product Discovery Survey Template by Maze Team at Maze

- In-App Surveys for Continuous Discovery by Teresa Torres at Product Talk

- Don't Send That Survey — Here's What To Do Instead by Tom Prior at Medium

- UX Research 101: Guide to Surveys by Hubble Team at Hubble

- How to Get Started with Discovery Research in UX by Nulab Team at Nulab