Idea Validation: Product

Partner & Supplier Interview

Verify feasibility of competing solutions before investing fully

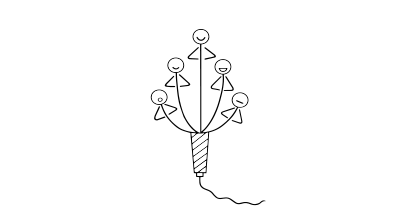

How: Interview potential key partners to identify barriers or risks to feasibility and compare and contrast alternative solutions. Evaluate the cost-benefit ratio, internal capacity, and the business and technical fit of the proposed solution.

Why: Understand the practical details of what it takes to make a solution come to life and how it can interface with your organization. Identify feasibility risks that need further investigation.

When building or scaling a product, it’s easy to concentrate research efforts on customers and experts—those who use the product or understand the domain. But often, valuable insight comes not just from the people you serve, but from those who help you deliver. This is where Partner and Supplier Interviews come in.

Unlike customer interviews that focus on needs, goals, and usability, or expert interviews that focus on market dynamics and trends, partner and supplier interviews are grounded in the operational reality of delivering your product or service. They provide insight into feasibility, logistics, scalability, and the often-invisible tradeoffs that affect cost, quality, and timelines.

These interviews are not about validating desirability or testing a new feature idea—they’re about understanding capability and risk. How well can your partners deliver what you envision? What constraints are non-negotiable? What hidden dependencies should be anticipated? In product discovery, especially when exploring new delivery models, supply chains, integrations, or fulfillment processes, these conversations are critical.

How are they different from other interviews?

In customer interviews, you’re listening for pain, motivation, and behavior. You’re trying to uncover whether a problem matters and how it manifests in someone’s life. In expert interviews, you’re looking at systems-level knowledge—trends, emerging patterns, and strategic context.

Partner and supplier interviews, however, are about execution. These stakeholders are the ones who make your roadmap real. They’re often closest to the limitations that don’t show up in a user journey map. You might hear about manufacturing tolerances, procurement lead times, data availability, legal restrictions, or integration friction. These insights won’t tell you if users want a feature, but they’ll help you understand if and how that feature can actually be built.

This method is most useful when your product relies on third-party capabilities—whether that’s physical distribution, software integration, white-labeled services, or upstream components.

When to conduct partner or supplier interviews

You should conduct partner and supplier interviews when:

- You’re exploring a solution that depends on infrastructure or services you don’t fully control.

- You’re considering a new go-to-market channel that includes partner enablement.

- You’re validating assumptions about cost, logistics, or scalability.

- You’re entering a new vertical or market that has regulatory or compliance implications.

For example, if you’re developing a new payment flow that depends on an external gateway, or launching a hardware product that will be assembled by a third-party manufacturer, you’ll want to talk to those teams early and understand their limitations, pricing models, and operational expectations.

These interviews are often overlooked in discovery because they don’t feel like traditional “user” research. But ignoring them can create blind spots that lead to scope creep, timeline overruns, or costly rework.

Partner bids

Getting key partners to bid on performing activities and delivering resources needed to feasibly run your business, you get evidence whether key partners are interested despite the lack of details you can provide. The more bids you get, the stronger evidence you have. This tests the interest of potential partners despite limited details but also evaluates their commitment and capacity to meet your needs. This in turn helps to assess the market’s readiness to support your product or service, identify potential partners’ and suppliers’ capabilities and limitations, and helps establish early relationships that can be critical for scaling your business.

How to conduct an effective interview

A good partner or supplier interview is structured, respectful, and grounded in collaboration. These are not interrogations; they’re co-discovery sessions.

Start with a clear statement of purpose. Let them know what you’re trying to build and why you’re seeking their input early. Emphasize that this isn’t a negotiation—it’s about understanding what’s possible.

Focus your questions on:

- Processes: How does your delivery process work from order to execution?

- Constraints: What are your hard limitations (volume, time, technical specs)?

- Flexibility: Where is there room for variation or customization?

- Dependencies: What do you need from us to deliver effectively?

- Historical challenges: What’s gone wrong in the past with similar clients?

Unlike customer interviews, it’s okay (and often expected) to share more details about your plans. You’re not trying to avoid bias—you’re trying to uncover mismatches or dependencies.

Be careful to set expectations with the partner or supplier. They might get the impression that you are actually going to carry out your plans. In reality, you are merely testing them. This is also why you should be careful with how much you share.

Analyzing and applying what you learn

The output of these interviews often looks different from a persona or opportunity map. You’re not mapping emotions or outcomes, but documenting feasibility boundaries, assumptions to validate, and system interactions to design around.

Use what you learn to:

- Refine delivery assumptions in your business model.

- Flag operational risks early in roadmap planning.

- Prioritize requirements based on supply-side limitations.

- Explore alternate partnerships or delivery mechanisms.

For example, if a logistics partner reveals a two-week lead time for a component that your product assumes can ship next-day, that insight directly affects your UX design, pricing model, and customer communication strategy.

Pairing with other methods

Partner and supplier interviews are especially useful when layered with:

- Customer interviews to test how expectations align with what’s operationally feasible.

- Feasibility experiments or technical spikes to prototype integrations.

- Journey mapping that includes backstage operations.

- Assumption mapping to identify what’s been taken for granted.

When discovery is holistic, it includes not just what’s desirable and viable, but also what’s feasible. These interviews help anchor your strategy in operational truth.

Partner and supplier interviews are not glamorous. They don’t yield emotional quotes or dramatic moments. But they offer something just as important: grounded clarity. In an age where product discovery too often overweights what customers say and underweights how businesses actually work, these interviews fill in critical gaps.

They remind us that every great experience also has a backend—and if that backend can’t deliver, the whole product falters. By listening to the people who keep that backend running, you build not just what users want, but what the business can sustain.

A collection of clever product discovery methods that help you get to the bottom of customer needs and coining the right problem before building solutions. They are regularly used by product builders at companies like Google, Facebook, Dropbox, and Amazon.

Get your deck!Related plays

- Testing Business Ideas by David J. Bland & Alexander Osterwalder

- What information should be included in a feasibility assessment?