Persuasive Patterns: Influence

Cashless Effect

We spend more when no cash is involved in a transaction

When we rely on credit cards, digital wallets, or other cashless transactions, the act of spending feels less tangible. The absence of physical bills and coins disrupts the mental connection between money spent and the value of that money. This, in turn, can lead us to spend more freely.

The Cashless Effect plays a surprising role in our everyday spending habits. Imagine you’re at a local farmer’s market. As you browse vibrant stalls overflowing with fresh produce, you decide to purchase a basket of berries. Reaching into your wallet, you find a limited amount of cash. Knowing you have a well-stocked digital wallet, you opt to use contactless payment. The transaction is quick and effortless, and you walk away with your berries, barely registering the amount spent. Research by Soman (2003) supports this phenomenon. They found that people spent less money on laundry when using cash-operated machines compared to those using prepaid cards. The physical act of handing over cash seems to make the transaction more tangible, potentially leading to more mindful spending.

This disconnect between physical cash and digital transactions extends to the digital world as well. Imagine browsing an online clothing store. You find a stylish shirt you like, but hesitate slightly due to the price. However, the checkout process is incredibly smooth – a few clicks and your new shirt is on its way. The ease of the cashless transaction, coupled with the absence of physical cash changing hands, might make the purchase feel less significant financially. This aligns with studies by Raghubir et al. (2009) who found that people spent more money when using credit cards compared to cash. The convenience and lack of physical exchange associated with cashless transactions can influence us to spend more freely online.

The study

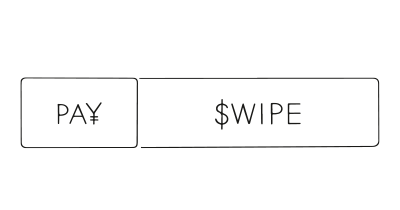

The Cashless Effect holds surprising power over our spending habits. In a vending machine experiment conducted by researchers at Cornell University. They set up two vending machines side-by-side, each dispensing the same candy bar. One machine only accepted cash, while the other accepted credit cards. The outcome was significant: people were nearly twice as likely to buy a candy bar when they could use credit cards (73% with credit cards vs. 38% with cash). This clever setup demonstrates the Cashless Effect in action.

This study sheds light on how the lack of physical cash influences spending. When we hand over bills and coins, the physical act of parting with money seems more concrete. This tangibility potentially makes us more mindful of the transaction’s value. Conversely, swiping a credit card or using a digital wallet feels less real, which might lead us to spend more freely without fully registering the cost. In essence, the Cashless Effect disrupts the mental connection between spending and the value of that money.

Read, D., Loewenstein, G., & Raghubir, R. (2009). The feeling of money: The effect of transaction framing on real-world purchase behavior. Journal of Experimental Psychology: Applied, 15(1), 77-89.

The Cashless Effect is rooted in the concept of mental accounting, a theory developed by Nobel laureate Richard Thaler (1980). Mental accounting refers to the way we categorize and track our money in our minds. Physical cash acts as a tangible representation of value, creating a separate mental account for the cash we hold. Spending from this account feels more significant because we can directly perceive the reduction in our available cash.

In contrast, cashless transactions lack this tangibility. Swiping a credit card or using a digital wallet doesn’t involve a physical exchange, potentially leading us to rely on less precise mental accounting. Without the concrete reminder of depleting cash, our mental accounts for spending might become fuzzier.

We might underestimate the true cost of our purchases, especially for small transactions, because we don’t physically see the money leaving our possession. Essentially, the Cashless Effect disrupts the mental connection between swiping a card and the value of that money. This disconnect can lead to looser spending habits, as the perceived cost of each transaction feels less significant.

Designing products with the Cashless Effect

The rise of cashless transactions presents an opportunity for designers: creating user experiences that are both frictionless and promote responsible spending.

The core principle lies in streamlining the checkout process. The easier and faster it is to pay, the more likely users are to complete transactions. Think Apple Pay or one-click purchasing – these technologies capitalize on reducing the “pain of paying.” However, this ease of use can be a double-edged sword. While convenience is key, it shouldn’t come at the expense of mindful spending.

Consider allowing users to track spending and establish limits, similar to withdrawing a specific amount of cash for weekly spending. By providing users with tools for financial awareness, you empower them to make informed decisions alongside the convenience of cashless transactions.

While cashless transactions lack the tangible connection of cash, design can bridge this gap. High-quality product images, detailed descriptions, and informative content can all help users feel confident about their purchases. Remember, the Cashless Effect shouldn’t come at the expense of informed decision-making.

The Cashless Effect offers a powerful tool, but user well-being should be a top priority. By focusing on transparency, user control, and responsible design principles, you can leverage the ease of cashless transactions to create a seamless and positive user experience. This, in turn, fosters trust and builds sustainable customer relationships.

Ethical recommendations

Overly aggressive tactics can backfire. Bombarding users with hidden fees, pre-selected high tipping options, or excessively complex pricing structures can erode trust and create a negative user experience. Furthermore, the ease of cashless transactions can mask the true cost of purchases, potentially leading to overspending, particularly for vulnerable populations.

Transparency is paramount. Clearly disclose all costs associated with a purchase, avoiding hidden fees or surprise charges. Offer users control over their spending with features like budgeting tools, spending limits, and clear cashless transaction breakdowns. Additionally, prioritize user education. Equipping users with information about the Cashless Effect empowers them to make informed financial decisions alongside the convenience of cashless transactions.

Real life Cashless Effect examples

Amazon

Amazon has mastered the use of cashless transactions to boost consumer spending. The one-click ordering system minimizes the psychological barriers associated with spending cash, enabling higher average order values. By removing the tangible aspect of cash, consumers are less aware of the expenditure, leading to more frequent and larger purchases.

Spotify

Subscription services like Spotify utilize automatic monthly renewals which are charged directly to credit cards or through digital wallets. This cashless model reduces the friction in transaction processes, lowering the psychological cost of spending and decreasing the likelihood of subscription cancellations due to the convenience and ‘out-of-sight, out-of-mind’ nature of the payments.

Gaming & online betting

Video games and online casinos have integrated in-game currencies and betting credits that users purchase with real money. These credits, which often come in large bundles, mask the actual cost and can lead to greater expenditure. For instance, players may purchase credits to use in digital slot machines or for buying cosmetic items in video games, spending more than they might if direct cash transactions were required.

Trigger Questions

- Can we simplify our checkout process further?

- Do we provide clear value cues for users considering cashless purchases?

- Are all costs transparent and upfront during the buying journey?

- Do users have tools to manage their spending within our cashless system?

- Are we prioritizing convenience without sacrificing user control?

- How can we leverage design to bridge the gap between cashless transactions and informed decision-making?

- How can we integrate cashless options while maintaining trust and security?

Pairings

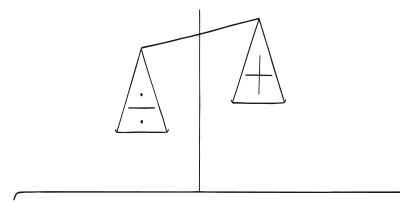

Cashless Effect + Framing Effect

How offers are framed can significantly influence consumer behavior in conjunction with cashless payments. Presenting prices in a way that highlights the benefits of cashless options, such as smaller, more manageable amounts when paid over time, can encourage higher spending. Frame cashless payments as the smarter, more economical choice, with breakdowns showing smaller periodic payments rather than full prices upfront.

We spend more when no cash is involved in a transaction

The way a fact is presented greatly alters our judgment and decisions

Cashless Effect + Commitment & Consistency + Sunk Cost Bias

People tend to follow through on commitments they’ve made. Offer free trials or subscriptions with cashless billing. Entering your credit card number for a free trial does not cost a thing today, but will when the free trial ends. Once users experience the convenience and establish a routine, they are more likely to continue with cashless payments.

We spend more when no cash is involved in a transaction

We want to appear consistent with our stated beliefs and prior actions

We are hesitant to pull out of something we have put effort into

Cashless Effect + Endowment Effect

We value things we already own more than things we don’t. Combine the Cashless Effect with the Endowment Effect by offering loyalty programs or reward points tied to cashless transactions. Earning rewards for using cashless methods creates a sense of ownership and incentivizes continued use.

We spend more when no cash is involved in a transaction

We value objects more once we feel we own them

Cashless Effect + Rewards

Rewards, especially when paired with cashless transactions, can further minimize the psychological barrier to spending. For example, offering cashback or points when using a card or digital wallet can incentivize users to spend more, leveraging both the Cashless Effect and the Rewards pattern. Design rewards that are automatically applied to cashless purchases to enhance the perceived value and immediacy of rewards, encouraging repeated behavior.

We spend more when no cash is involved in a transaction

Use rewards to encourage continuation of wanted behavior

Cashless Effect + Scarcity Bias

The urgency created by Scarcity can complement the Cashless Effect by nudging consumers to make quick decisions. Cashless transactions reduce the friction in these urgent buying situations, making it easier for users to act before the opportunity disappears. Use time-limited offers or exclusive sales that require immediate, cashless payment to capitalize on this combined effect.

We spend more when no cash is involved in a transaction

We value something more when it is in short supply

Cashless Effect + Loss Aversion

This pairing works by emphasizing what consumers would lose if they do not take advantage of a cashless transaction opportunity. For instance, coupling exclusive discounts for cashless payments with reminders of the extra costs when using cash can be powerful. Clearly communicate the benefits of cashless transactions in terms of savings, convenience, and additional rewards, highlighting what is lost when choosing other payment methods.

We spend more when no cash is involved in a transaction

Our fear of losing motivates us more than the prospect of gaining

A brainstorming tool packed with tactics from psychology that will help you increase conversions and drive decisions. presented in a manner easily referenced and used as a brainstorming tool.

Get your deck!- The Effect of Payment Transparency on Consumption [ by Soman

- Differences in Consumer Purchase Behavior by Credit Card Payment System by Hirschman, E. C.

- The Cashless Effect by Moneythor Team at Moneythor

- Cashless Effect

- Cashless Effect at The Decision Lab

- Soman, D. (2003). The effect of payment transparency on consumption: Quasi-experiments from the field. Marketing Letters, 14(1), 39-48.

- Hirschman, E. C. (1979). Differences in Consumer Purchase Behavior by Credit Card Payment System. Journal of Consumer Research, 6(1), 58-66.

- Feinberg, R. (n.d.). Credit Cards as Spending Facilitating Stimuli: A conditioning interpretation. Journal of Consumer Research, 13(1), 348-356.

- Raghubir, R., Kumaran, V., & Dlabay, W. R. (2009). The illusion of fungibility: Effects of payment modality on spending behavior. Journal of Consumer Research, 36(6), 853-863.

- Read, D., Loewenstein, G., & Raghubir, R. (2009). The feeling of money: The effect of transaction framing on real-world purchase behavior. Journal of Experimental Psychology: Applied, 15(1), 77-89.

- Thaler, R. H. (1980). Toward a descriptive theory of consumer choice. Journal of Economic Behavior and Organization, 1(1), 39-60.