Risk Aversion refers to the psychological tendency to avoid uncertainty and stick to familiar options. This pattern highlights how individuals generally prefer to minimize potential losses, even at the expense of potential gains.

Imagine you’re meeting a friend for dinner in an unfamiliar neighborhood. Faced with a row of restaurants – a bustling Italian place with enticing aromas, a trendy new vegan eatery, and a familiar Chinese restaurant you’ve enjoyed previously – you might find yourself gravitating towards the Chinese restaurant. This decision reflects risk aversion. The familiar menu, the knowledge of what to expect regarding portion sizes and taste, and the positive past experiences all contribute to a sense of certainty and comfort. Venturing into the unknown, with the possibility of disappointment, feels less appealing.

Digital product creators know this and often play on risk aversion to influence user behavior. Music streaming services typically feature prominently “Recently Played” or “Liked Songs” playlists, showcasing familiar music choices. This reduces the decision fatigue associated with exploring new music and encourages users to stick with what they know they enjoy. Similarly, e-commerce platforms might recommend products based on past purchase history, presenting users with familiar options that align with their previous preferences. These practices leverage risk aversion by minimizing the uncertainty associated with new choices and steering users towards comfortable, familiar territory.

The study

A seminal study illustrating the power of Risk Aversion is the work by Daniel Kahneman and Amos Tversky on Prospect Theory. This research sheds light on how people evaluate gains and losses, emphasizing that losses loom larger than gains. In their experiments, they found that individuals tend to overvalue losses compared to equivalent gains, often by a ratio of about 2:1 . This insight reveals the psychological mechanisms that drive Risk Aversion and its impact on decision-making.

In their iconic experiment participants were presented with two scenarios:

Scenario A: Gain a guaranteed $250.

Scenario B: 50% chance of winning $500 and a 50% chance of winning nothing.

While the expected value of both scenarios is identical ($250), a staggering majority of participants opted for Scenario A, the certain gain. This aversion to the uncertainty of Scenario B, even though it offered the potential for a higher reward, highlights the powerful influence of risk aversion in our decision-making processes.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

Risk Aversion is rooted in behavioral psychology and decision-making theories. It reflects the inherent fear of loss and uncertainty that influences how people make choices. This pattern aims to guide users towards safer, familiar options, avoiding perceived risks. Its primary goal is to reduce anxiety and hesitation, leading to more comfortable and confident decisions.

Risk Aversion is a fundamental human behavior that shapes how we navigate uncertainty. It encompasses a range of psychological principles that influence our decision-making, particularly when faced with choices that involve potential gains or losses. Let’s delve deeper into these principles to understand why we sometimes prioritize the familiar over the potentially rewarding.

Loss Aversion: we feel losses more intensely

A cornerstone of Risk Aversion is the concept of loss aversion, introduced by Kahneman and Tversky (1979). It suggests that we experience losses more intensely than we experience gains of equivalent value. Imagine losing $100 feels significantly worse than finding $100 feels good, even though the monetary value is the same. This asymmetry in perceived value pushes us towards choices that minimize the risk of incurring losses, even if it means sacrificing potential gains (Rottenstreich & Greenleaf, 2011).

Our decision-making is further influenced by cognitive biases. Here are three key biases that interact with Risk Aversion:

- Status Quo Bias

We tend to favor maintaining the current state (Samuelson & Zeckhauser, 1988). This can explain why someone might stick with a familiar service, even if a new one offers better features, simply because switching introduces uncertainty. - Endowment Effect

We value things we already own more than things we don’t (Kahneman, Knetsch, & Thaler, 1990). This can make us averse to trading or switching options, even if it might be beneficial (Thaler, 1980). - Availability Heuristic

We judge the likelihood of events based on how easily examples come to mind (Kahneman & Tversky, 1979). If negative outcomes or failures are more readily remembered, people may overestimate the risk associated with uncertain choices (Huang et al., 2015).

Our perception of risk also plays a significant role in Risk Aversion. Here are some factors that influence how we assess potential dangers or uncertainties:

- Personal experiences

Past experiences can significantly impact how we view risk. A negative experience, such as a bad investment, can make someone more hesitant to take risks in the future. - Cultural and social factors

Social norms and cultural context can shape risk perception. Societies that discourage risk-taking might have individuals who are more likely to avoid uncertainty (Heath et al., 1999). - Media and communication

How risks are framed by the media can shape perceptions (Samuelson & Zeckhauser, 1988). Sensationalized news coverage of potential dangers can lead to an inflated sense of risk.

Risk Aversion in decision-making

By acknowledging these psychological principles, designers and decision-makers can create strategies that address these biases and perceptions. For instance, clear communication that highlights both the benefits and potential drawbacks of a choice, along with strategies to mitigate losses, can empower individuals to overcome Risk Aversion and make more informed choices.

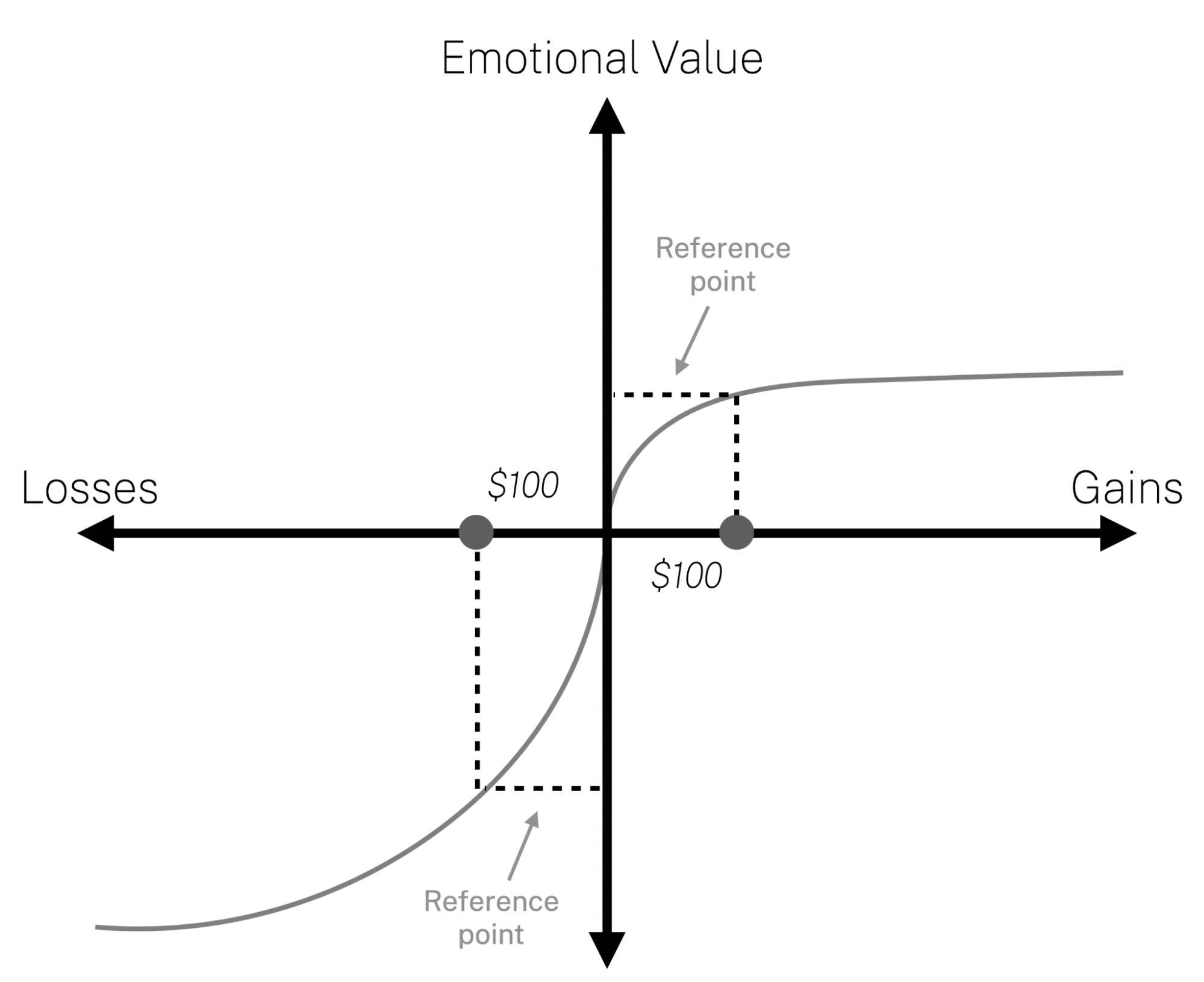

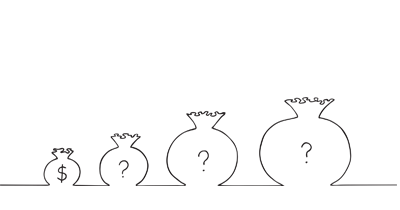

Prospect Theory, developed by Kahneman and Tversky (1979), provides a valuable framework for understanding Risk Aversion. It posits that individuals make decisions based on the perceived value of potential gains and losses, rather than solely on the expected value (average outcome) of an option. This theory highlights two key aspects:

- Loss Aversion

As mentioned earlier, losses are felt more intensely than gains. - Diminishing sensitivity

The impact of gains and losses diminishes as the magnitude of those outcomes increases. For instance, the difference between gaining $10 and $20 might feel significant, but the difference between gaining $1000 and $1100 might feel less impactful. This explains why individuals may be more risk-averse for smaller stakes and more willing to take risks when dealing with larger potential gains or losses (Schkade & Hershey, 1995).

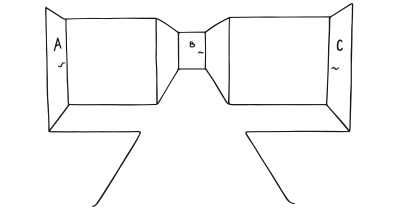

The Prospect Theory graph depicts a value function that helps explain how individuals evaluate gains and losses.

Here’s a breakdown of its key characteristics:

- Asymmetrical shape

The graph shows a distinct asymmetry between gains and losses. The curve is concave for gains, meaning that the subjective value of gains diminishes as they increase. For example, going from $100 to $200 may feel less impactful than going from $0 to $100. The curve is convex for losses, indicating that the negative impact of losses grows more pronounced as they increase. - Losses feel more painful

A central idea of Prospect Theory is loss aversion, clearly represented in this graph. The downward slope for losses is steeper than the upward slope for gains, indicating that losses have a greater psychological impact than gains of similar magnitude. This leads individuals to prefer avoiding losses over acquiring gains. - Reference point

Another important aspect of the graph is the reference point, which divides gains from losses. The reference point represents an individual’s current state or expectation. Changes in wealth or resources are evaluated relative to this reference point, meaning that outcomes perceived as gains or losses depend on where the reference point is set. For instance, imagine someone’s reference point is their current savings of $1000. Gaining $100 from that point would be a positive outcome, while losing $100 would be a negative outcome.

The value function depicted by Prospect Theory helps explain several key aspects of Risk Aversion:

- We have a preference for certainty

The asymmetrical value function explains why individuals prefer certainty over uncertainty. The potential pain of losses looms larger than the pleasure of gains, making individuals more inclined to stick to what they know or choose guaranteed outcomes, even if uncertain options offer higher potential rewards. - We are risk-seeking in the loss domain

Interestingly, the convex curve in the loss domain suggests that individuals might take on more risk when trying to avoid or recoup losses. Imagine someone loses $100 (a steeper decline in value). To regain that loss, they might be more willing to take a risky gamble, even if the odds of success are low. This risk-seeking behavior in the face of losses is another facet of Prospect Theory that can lead to irrational or inconsistent decision-making. - Framing Effects

The reference point highlights how the framing of decisions can impact risk perception. By shifting the reference point, individuals can perceive the same outcome as either a gain or a loss, influencing their willingness to take risks. For instance, framing a discount as “saving $50” emphasizes the gain, while framing it as “paying $95” emphasizes the potential loss, potentially influencing purchase decisions.

Understanding Risk Aversion and Prospect Theory empowers us to make better choices and design experiences that nudge users towards informed decisions. By acknowledging the psychological biases that influence our risk perception, such as loss aversion and the framing of options, we can create strategies that mitigate the impact of uncertainty and encourage balanced decision-making.

Designing products using Risk Aversion

One way designers can leverage Risk Aversion is by framing choices to mitigate loss aversion. Imagine a freemium service. Highlighting the potential loss of full access after a trial, rather than simply listing limitations, emphasizes the value users already experienced and nudges them to subscribe.

Defaults also play a role. Pre-selecting a familiar option, like standard shipping over expedited options, reduces the perceived risk associated with that choice. This minimizes the uncertainty of exploring alternative choices.

Highlighting certainty through guarantees and clear explanations is another effective strategy. Money-back guarantees, free trials, and clear feature explanations all work to reduce perceived risk. Imagine a language learning app showcasing success stories alongside a money-back guarantee. This social proof combined with a clear guarantee significantly reduces the perceived risk of subscribing.

Transparency is key in both designing to mitigate risk aversion and designing with its potential for influence in mind. Misleading users or obscuring information erodes trust. Clearly explaining features, limitations, and potential outcomes empowers users to make informed decisions, mitigating the perceived risk associated with those choices. This fosters a positive user experience.

Prospect Theory offers additional insights. Clear communication of both potential gains and losses can help users overcome risk aversion. Framing outcomes to emphasize potential gains, focusing on what users acquire rather than what they might miss out on, can also counteract loss aversion. Decision support tools can further help users weigh gains and losses more accurately, leading to more balanced decision-making.

Here’s how to translate these concepts into practical design choices:

- Highlight the familiar

When introducing new features, emphasize how they build upon existing functionalities. This bridges the gap between the familiar and the novel, reducing perceived risk. For instance, a new social media platform might highlight how easily users can import friend lists from other platforms. - Focus on gains

Acknowledge potential benefits but frame losses cautiously. Instead of highlighting what users might miss out on, emphasize gains in efficiency, time saved, or improved outcomes. For instance, a budgeting app might showcase how users can avoid overspending pitfalls through automated features, focusing on the positive outcome of financial security. - Provide guarantees and risk reversal options

Offer money-back guarantees, free trials, or clear return policies. This significantly reduces the perceived risk associated with trying a new product or service. It allows users to experience the benefits firsthand, mitigating any initial hesitation. - Showcase Social Proof

People trust the experiences of others. Incorporate user testimonials, positive reviews, or showcase how many people are already using a product or service. This social proof leverages the power of others’ experiences to reduce the perceived risk of adoption. Imagine an e-commerce platform displaying customer satisfaction ratings alongside product descriptions.

Following these principles can help foster trust, reduce user friction, and guide users towards informed choices that benefit them and the product.

Ethical recommendations

Risk aversion is a powerful pattern in guiding user behavior. However, it can be misused in ways that may lead to unintended or unethical outcomes.

One concern is the creation of a manipulative environment. Overly complex return policies or misleading guarantees can erode trust. Similarly, leveraging social proof through fake reviews or inauthentic testimonials can backfire. Additionally, exploiting Risk Aversion to pressure users into hurried decisions, obscuring limitations, or creating a gated user experience can be detrimental. These practices alienate users and ultimately undermine the persuasive power of the pattern itself.

Another such risk involves manipulating users into avoiding alternatives by highlighting negative aspects disproportionately. This can lead to “fear-based” marketing or design tactics, where products or services are framed in a way that overemphasizes potential losses, limiting user choice. Additionally, pre-selected options, while effective in reducing uncertainty, can also restrict genuine decision-making, guiding users towards choices that may not necessarily align with their best interests.

Further, emphasizing loss aversion may deter users from exploring new and potentially beneficial products, limiting innovation and personal growth. Users may also face decision fatigue from persistent framing of potential risks, making them less likely to engage positively.

To ensure that risk aversion is used ethically and in a user-centric manner, designers should consider the following recommendations:

- Balance framing

Ensure that the framing of choices offers a balanced view, presenting both potential gains and losses. This helps users make informed decisions without feeling manipulated or coerced. - Be transparent

Provide clear, transparent information on all aspects of the product or service. This includes pricing, features, and potential risks, allowing users to evaluate options thoroughly. - Empower user choice

Encourage genuine decision-making by offering diverse options and minimizing pre-selection. This allows users to explore different paths and find the one that best suits their needs. - Focus on positive outcomes

While acknowledging potential losses, also emphasize the positive outcomes of desired behaviors. This can guide users towards beneficial decisions without relying heavily on fear tactics. - Support exploration

Create an environment that encourages exploration and learning. This might involve offering free trials, tutorials, or interactive guides to reduce the perceived risk of trying new products. - Use authentic Social Proof

Showcase genuine user experiences and testimonials. Partner with credible sources for endorsements and avoid misleading positivity. Social proof should be relevant to the target audience and foster trust. - Provide meaningful guarantees

Offer clear, transparent, and easy-to-execute guarantees. Empty promises or overly complex return policies breed suspicion. Guarantees should build trust and empower users to explore new options with confidence. - Apply respectful defaults

Utilize defaults strategically, but avoid manipulating user choices. Pre-selected options should be reasonable and easily changeable. The goal is to guide users, not restrict them.

Real life Risk Aversion examples

Uber

The app provides upfront fare estimates, real-time tracking, and driver ratings to minimize uncertainties. This transparency helps users feel secure when booking rides. Moreover, Uber’s integration with payment options and its feedback system for riders and drivers ensure accountability, reducing the perceived risks associated with using the service.

Airbnb

For guests, the platform provides detailed property descriptions, user reviews, and ratings to reduce perceived risks. This transparency builds trust and reduces uncertainty, making it easier for guests to book accommodations. Additionally, Airbnb’s host verification process, safety measures, and customer support ensure a reliable experience, addressing both sides’ concerns and making the platform a trustworthy choice for users.

Amazon Prime

Amazon effectively leverages risk aversion through its Prime subscription service. By offering a free trial and emphasizing features like free shipping, streaming services, and exclusive deals, Amazon reduces users’ perceived risks. This approach encourages subscriptions, highlighting potential losses users might face without the service.

Trigger Questions

- How can we leverage familiar features to introduce new functionalities?

- How can we frame the benefits of a new option to outweigh potential drawbacks?

- What guarantees or risk reversal options can we offer to minimize perceived risk?

- Do we offer risk-free trials or money-back guarantees to reduce perceived risks?

- How can we incorporate social proof to build trust and reduce user uncertainty?

- Are we clearly communicating all relevant information, including potential limitations?

- Does our onboarding process allow users to explore value before full commitment?

- How do we provide feedback and reassurance throughout the user journey?

- Are our touchpoints consistent, creating a seamless user experience?

Pairings

Risk Aversion + Loss Aversion

This pattern emphasizes how people tend to weigh potential losses more heavily than gains. By combining risk aversion with loss aversion, designers can frame choices in ways that mitigate users’ fears of losing something valuable, encouraging more cautious decision-making. For example, an e-commerce platform might highlight discounts as a way to avoid overpaying, making the choice to purchase feel safer.

We avoid uncertainty and stick to what we know

Our fear of losing motivates us more than the prospect of gaining

Risk Aversion + Commitment & Consistency

This pattern leverages the psychological principle that people prefer to stay consistent with their past decisions. Combining this with risk aversion can help reinforce users’ decisions, making them feel safer in sticking to a previously chosen path. For instance, a streaming service can offer recommendations based on past viewing history, aligning new choices with previous ones and reducing perceived risks.

We avoid uncertainty and stick to what we know

We want to appear consistent with our stated beliefs and prior actions

Risk Aversion + Social Proof

Social proof capitalizes on our tendency to trust the experiences of others. Pairing this with Risk Aversion creates a powerful duo. Imagine a new fitness app showcasing success stories and positive testimonials alongside free trials. This combination reduces the perceived risk of trying something new (Risk Aversion) while leveraging the trust instilled by social proof (Social Proof). Services like Airbnb successfully leverage this pairing by displaying host reviews alongside listings, encouraging users to explore unfamiliar accommodations.

We avoid uncertainty and stick to what we know

We assume the actions of others in new or unfamiliar situations

Risk Aversion + Anchoring Bias

This pattern leverages the tendency for people to rely heavily on the first piece of information they encounter when making decisions. By combining anchoring bias with risk aversion, designers can set initial impressions that frame subsequent choices, making users feel more comfortable. For example, a software platform might start with a basic feature set as an anchor, allowing users to explore more complex options with reduced uncertainty.

We avoid uncertainty and stick to what we know

We tend to rely too heavily on the first information presented

Risk Aversion + Scarcity Bias

Scarcity highlights the limited availability of an offer, triggering a desire to act before it disappears. This urgency can nudge users past their Risk Aversion. For instance, an e-commerce platform might offer a limited-time discount on a new product. The perceived scarcity (Scarcity) encourages users to overcome their initial hesitation about trying a new product (Risk Aversion), potentially leading to a purchase. Flash sales and limited-edition products are common examples of this pairing in action.

We avoid uncertainty and stick to what we know

We value something more when it is in short supply

Risk Aversion + Authority Bias

People tend to trust figures of authority. Combining this with Risk Aversion can be persuasive. Imagine a financial planning service featuring endorsements from reputable financial advisors. The perceived expertise of the authority figure (Authority Bias) reduces the uncertainty associated with financial decisions (Risk Aversion), potentially leading users to consider the service. Many financial institutions leverage this pairing by featuring testimonials from industry experts to build trust in their services.

We avoid uncertainty and stick to what we know

We have a strong tendency to comply with authority figures

Risk Aversion + Framing Effect

The framing effect highlights how presenting information can influence our choices. This can be strategically paired with Risk Aversion. Imagine a language learning app emphasizing the positive outcomes of fluency, like increased travel opportunities (framing as a gain). This approach (Framing Effect) can help users overcome their hesitation about trying a new learning method (Risk Aversion). Many health campaigns successfully leverage this pairing by focusing on the benefits of healthy habits (e.g., living a longer life) rather than solely dwelling on the negative consequences of unhealthy choices.

We avoid uncertainty and stick to what we know

The way a fact is presented greatly alters our judgment and decisions

Risk Aversion + Liking Bias

We tend to be more receptive to people or things we like. This can be a powerful companion to Risk Aversion. Imagine an e-commerce platform recommending products based on a user’s past purchases. This personalization (Liking Bias) increases the perceived relevance of recommendations, potentially reducing the user’s hesitancy to explore new items (Risk Aversion). Streaming services that curate playlists based on user preferences are a good example of this pairing in action.

We avoid uncertainty and stick to what we know

We prefer to say yes to the requests of someone we know and like

Risk Aversion + Commitment & Consistency

Once we commit to something, we’re more likely to follow through. This principle can be harnessed alongside Risk Aversion. Imagine a fitness app offering a free initial workout plan. By allowing users to experience the value firsthand (Commitment & Consistency), the app reduces the perceived risk of subscribing for continued access (Risk Aversion). Gyms that offer free trial memberships leverage this pairing to encourage users to experience the benefits of exercise before committing to a long-term membership.

We avoid uncertainty and stick to what we know

We want to appear consistent with our stated beliefs and prior actions

Risk Aversion + Endowment Effect

We tend to value things we already own more than things we don’t. This can be a curious but effective partner for Risk Aversion. Imagine a software service offering a freemium model with limited features. Users who invest time customizing their free account experience the Endowment Effect, potentially increasing their hesitation to switch to a paid plan (Risk Aversion) even if it offers more features. Freemium models across various industries often rely on this pairing, hoping users become invested enough in the free version to resist upgrading despite limitations.

We avoid uncertainty and stick to what we know

We value objects more once we feel we own them

Risk Aversion + Status-Quo Bias

This pattern reflects the tendency for individuals to prefer the current state of affairs over change. Pairing this with risk aversion reinforces the inclination to stick with familiar options, making new products or services feel riskier by comparison. For instance, a financial service can emphasize the stability of sticking to tried-and-true investment options, reducing the perceived risk of exploring new markets.

We avoid uncertainty and stick to what we know

We prefer the current state instead of comparing actual benefits to actual costs

Risk Aversion + Default Effect

Pre-selected options can influence our decisions. This can be a subtle but effective strategy when combined with Risk Aversion. Imagine a travel booking platform that pre-selects a standard travel insurance option during checkout. This default selection reduces the cognitive load associated with making a decision (Risk Aversion), potentially leading users to accept the pre-selected insurance. Many subscription services leverage this pairing by setting a monthly billing cycle as the default option during sign-up.

We avoid uncertainty and stick to what we know

We are more likely to choose a pre-selected option

Risk Aversion + Need for Closure

This pattern highlights the desire for definitive conclusions and aversion to ambiguity. When combined with risk aversion, it can encourage users to make decisions that feel secure and final. For instance, a travel booking site might offer immediate confirmation emails and cancellation policies, reducing the uncertainty associated with booking and fulfilling the need for closure.

We avoid uncertainty and stick to what we know

We have a desire for definite cognitive closure as opposed to enduring ambiguity

A brainstorming tool packed with tactics from psychology that will help you increase conversions and drive decisions. presented in a manner easily referenced and used as a brainstorming tool.

Get your deck!- Prospect Theory: An Analysis of Decision under Risk by Kahneman & Tversky

- Loss Aversion in Riskless Choice: A Reference-Dependent Model by Tversky & Kahneman

- Rottenstreich, R., & Greenleaf, M. D. (2011). The happiness of knowing: How knowledge about future events promotes positive affect. Psychological Science, 22(3), 339-346.

- Huang, Y., Lu, Y., & Yen, D. C. (2015). The design of online recommendation systems: A review of navigation and decision-making support with empirical studies. Decision Support Systems, 78, 343-358.

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

- Heath, C., Larrick, R. P., & Wu, G. (1999). Bargaining in the shadow of the market. The Journal of Personality and Social Psychology, 77(6), 1492-1501.

- Schkade, D. A., & Hershey, J. C. (1995). Relative versus absolute preferences in risk aversion. Journal of Behavioral Decision Making, 8(4), 301-316.

- Thaler, R. H. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39-60.

- Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of Political Economy, 98(6), 1325-1348.

- Samuelson, W., & Zeckhauser, R. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty, 1(1), 7-59.